In addition to federal types like W-4 and I-9, many states require employers to report new hires to a designated agency. This reporting usually must happen inside 20 days of the employee’s start date. Having all this information upfront prevents errors that might lead to underpayment, overpayment, or missed tax deadlines.

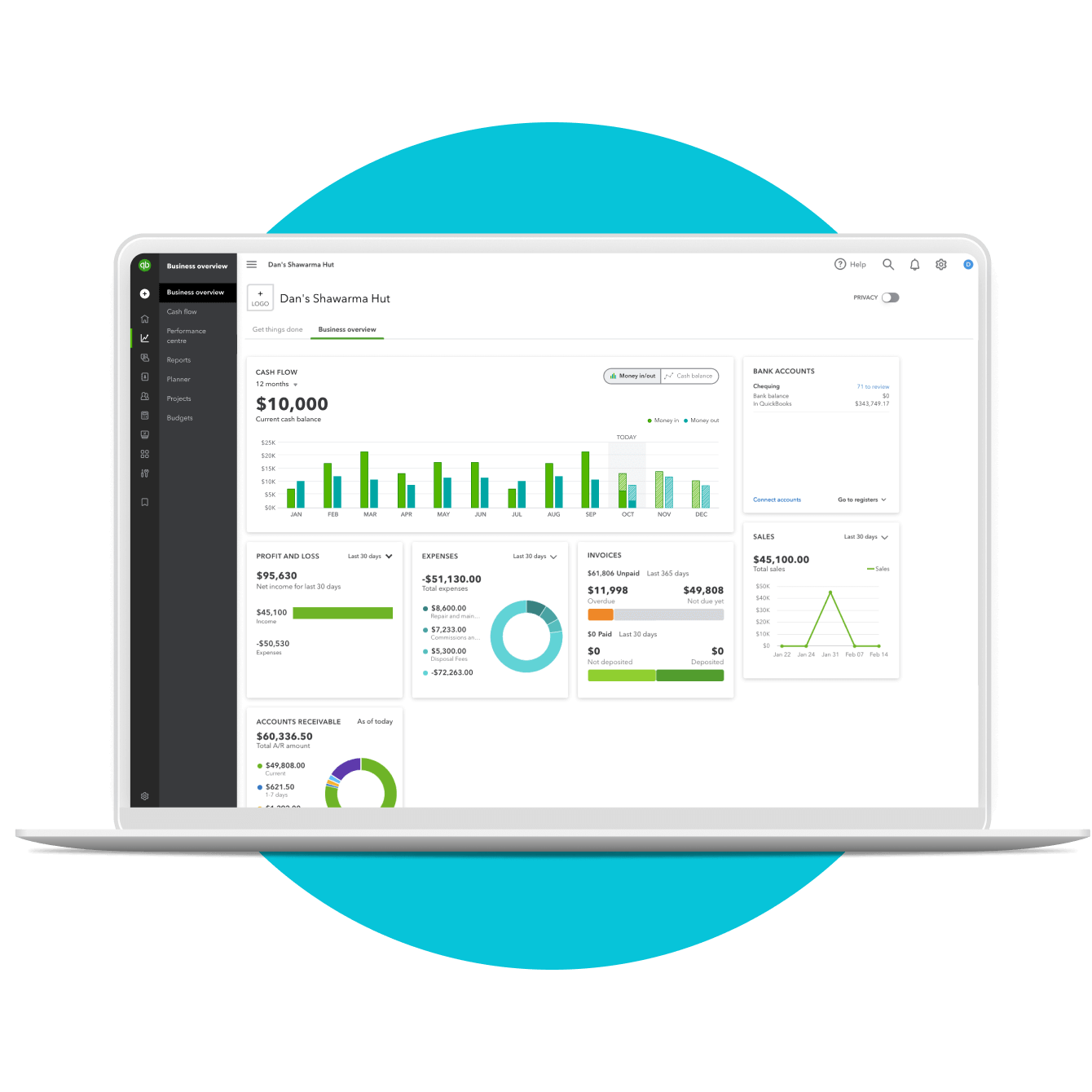

QuickBooks Payroll is a service application https://www.simple-accounting.org/ used to streamline accounting work and also help within the payroll processing of firm employees. It also involves calculating worker earnings and deducting federal and state payroll taxes. Payroll hereby means financial data of staff or the distribution of worker paychecks in a enterprise. Intuit’s payroll specialists can guide you step-by-step through the payroll setup and answer any questions you may have along the way. Easily manage your corporation accounting and payroll multi functional place. Intuit QuickBooks Payroll consultants will evaluation your payroll setup, or do it for you, so you’ll know it’s accomplished proper.

Payroll Software Program

QuickBooks Payroll can save you time and scale back the risk of payroll errors. As you become extra familiar with the software program, you’ll efficiently handle your payroll and ensure your workers are paid precisely and on time. The accounting software product QuickBooks was created and is commercially distributed by Intuit. Catering primarily to small and medium-sized enterprises, it provides each on-premises and cloud-based accounting functions. These iterations can course of payroll, handle and pay invoices, and accept enterprise payments.

This feature allows employees to access their pay stubs, tax varieties, and private information at their convenience. I found this incredibly useful as it reduces the executive burden on HR and payroll groups, while additionally enhancing employee satisfaction. You can present your team with the tools they should manage their own payroll data, fostering a extra engaged and informed workforce. Earlier Than paying staff, they’ll want to offer you some data. First, they should full a form that may assist you to collect all your employee’s personal data.

Price And Time Effectiveness

- You begin by choosing how usually you want to pay your workers – weekly, bi-weekly, or monthly.

- Widespread deductions include payroll taxes, payroll withholdings, wage garnishments, and profit deductions.

- ADP stays on top of fixing guidelines and legislation that will help you adjust to the newest payroll tax rules and rules.

- Here Is the place QuickBooks On-line Payroll acts as your very own financial compass.

As the business paying the freelancer or contractor, you are buying their service. Lumping in contractors and freelancers into your payroll course of may complicate your information. Instead, report contractor or freelancer payments as business expenses.

Integrating With Other Software Program

This wealth of knowledge helps you make informed decisions, main to better administration of your payroll bills. Sit back and watch as the software takes care of paying your staff and dealing with taxes. As you turn out to be familiar with the process, you will find it becomes a seamless a part of your business rhythm.

Its adaptability to various enterprise necessities, user-friendly interface, and complete characteristic set contribute to its widespread adoption. This blog explores the intricacies of how to do payroll in QuickBooks, guaranteeing a streamlined and compliant process for organizations of varying scales. Your knowledge’s safety is a top priority, and QuickBooks employs encryption and sturdy security measures to guard it.

We supply direct deposit and cellular payroll solutions that combine with time and attendance tracking. We additionally automatically calculate deductions for taxes and retirement contributions, and supply professional help to assist you stay compliant with rules. Pay workers right from QuickBooks, and get all your payroll tax forms are completed for you with Payroll Enhanced. QuickBooks Payroll offers 1099 E-File, staff compensation, labor law posters, worker benefits, direct deposit, and a payroll app.

You will have reasonably priced entry to full-service payroll at any plan level, free direct deposit, and a portal that lets employees observe vacation and sick time in the software. The Elite plan is at present discounted 50% to $62.50 per 30 days for the primary three months, which then jumps to $125 per thirty days, plus a $10 per worker additional fee. The Elite plan provides onboarding, entry to a personal HR advisor, plus all of the features found within the Core and Premium plans.

Establishing QuickBooks Payroll reduces the trouble of remembering the payday. The solely thing you have to do is to click on via a sequence of screens. This is the place you inform QuickBooks how to deal with the money part of the taxes.